10 Double Taxation Refers to Which of the Following Scenarios

12 Refer to Scenario 27-1. In the simple economic model scenario the tax multiplier equals.

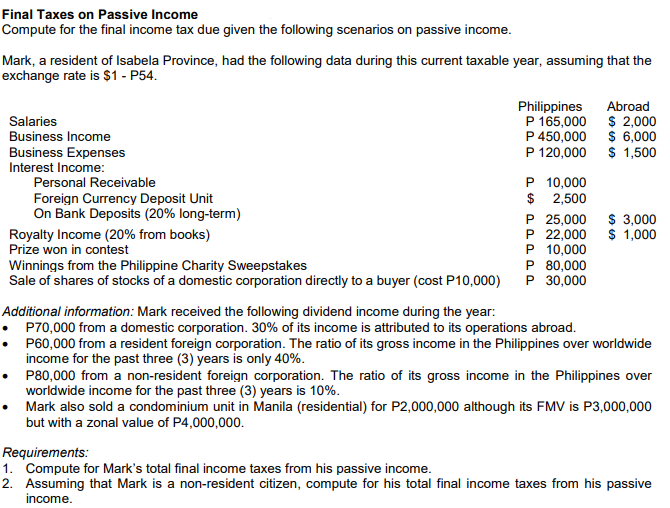

Answered Final Taxes On Passive Income Compute Bartleby

It can occur when income is taxed.

. 11 Double taxation refers to which of the following scenarios. It is a situation in which corporate earnings are taxed twice at two different levels but include the same income. When a tax of 1 per unit is imposed the price of the good rises to 6 per unitRefer to Scenario 194.

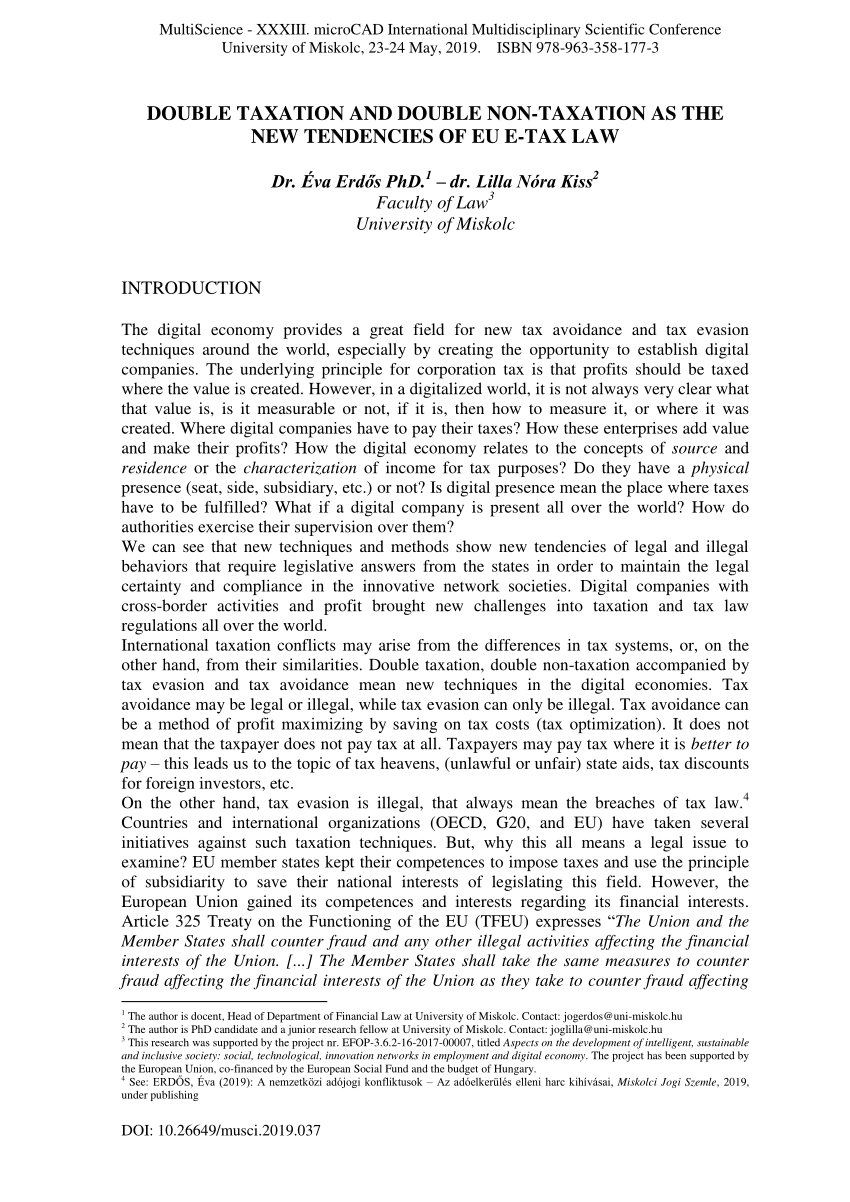

9 Which of the following is not an advantage of a sole proprietorship. B Public Ruling No. Originally the price of the good is 5 per unit.

For most examinations not tax regulations issued or legislation passed on or before 31 August annually will be examinable from 1 September of the following year to 31 August of the year after that. Philippines P 165000 Abroad Salaries Business Income 2000 P. So if estates were taxed it would certainly not be.

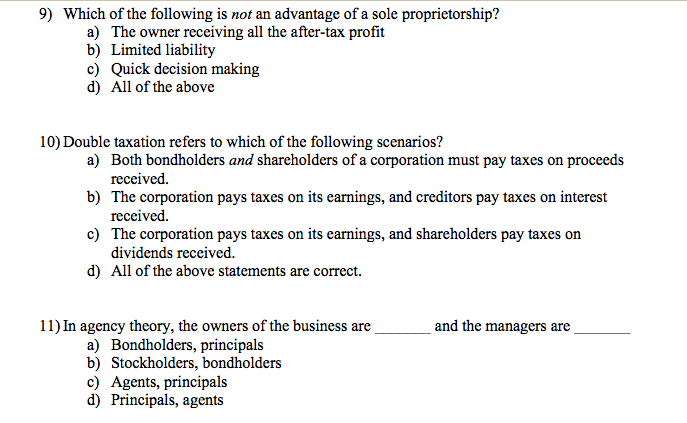

The over-riding objective of a DTA is the avoidance or minimisation of double taxation. Double taxation refers to which of the following scenarios. In the simple economic scenario above the balanced budget multiplier equals.

The corporation pays taxes on its earnings and shareholders pay taxes on dividends. For example tax rates can be increased in time of infl ation to reduce the taxpayers spending power and can be reduced during the time of recession to increase the spending power. Both bondholders and shareholders of a corporation must pay taxes on proceeds received.

A corporate organizations net income Net Income Net Income is a key line item not only in the income statement but in all three core financial statements. Double Taxation Refers to Which of the following Scenarios. The corporation pays taxes on earnings and creditors pay taxes on interest received.

This means that for any sort of income generated in a country there are agreed-upon tax rates and jurisdiction. The IRL variant tax examinations in. On March 10 2021 Royal Decree-Law 42021 of March 9 2021 was published which transposes Council Directive EU 20161164 of 12 July 2016 amended by Council Directive EU 2017952 of 28 May 2017 ATAD II Directive as regards hybrid mismatches and amends the corporate income tax and nonresident income tax laws.

C the double taxation agreement between Malaysia and. Both bondholders and shareholders must pay taxes. Double taxation is thus avoided.

Refer to Scenario 194 below to answer the questions that follow. The traditional view in regard to the concept of double taxation is that to constitute double taxation objectionable or prohibited the two or more taxes must be 1 imposed on the same property 2 by the same state or government 3 during the same taxing period and 4 for the same purpose. The income is taxable only in Country B and according to the rules of Country B.

Double taxation refers to which of the following scenarios. The corporation pays taxes on its earnings and shareholders pay taxes on dividends received. A Both bondholders and shareholders of a corporation must pay taxes on proceeds b The corporation pays taxes.

Double taxation refers to which of the following scenarios. Final Taxes on Passive Income Compute for the final income tax due given the following scenarios on passive income. If a taxpayer lives in one country but makes money in another he is covered by the Double.

On 16 February 2022 Colombia and the Kingdom of the Netherlands signed a double tax treaty DTT. The accountant appealed but still had to pay. A Both bondholders and shareholders of a corporation must pay taxes on proceeds received.

Suppose demand for widgets is given by the equation P 10 - 025Q. A Malaysian Income Tax Act 1967 You may refer to Section 4A Section 12 Section 15A Section 107A Section 109B and Schedule 1. After further phone calls an email was published stating that this pension was taxable in the UK.

14 Suppose instead of a fixed amount of taxes that there is a tax rate of 10 percent. C The corporation pays taxes on its earnings and shareholders pay taxes on dividends received. Please refer to the examinable documents for the exam where relevant for further information.

C The corporation pays taxes on its earnings and shareholders pay taxes on dividends received. Instead of paying tax of 55 person A pays only 30 globally on the profit of 100. OB The corporation pays taxes on its earnings and creditors pay taxes on interest received c The corporation pays taxes on its earnings and shareholders pay taxes on dividends.

What is the total burden of the tax. The tax office demanded a certificate from HMRC which it did not want to know stating that they should not issue certificates and refer the Spanish tax administration to the double taxation treaty. The income is taxable only in Country A and according to the rules of Country A.

Double taxation is a tax principle referring to income taxes paid twice on the same source of income. B The corporation pays taxes on its earnings and creditors pay taxes on interest received. A The owner receiving all the after-tax profit b Limited liability c Quick decision making d All of the above 10 Double taxation refers to which of the following scenarios.

The DTT aims to reduce taxation on transactions and investments between both countries without creating opportunities for non-taxation tax evasion or tax avoidance. 13 Canons of Taxation 131 Defi nition of Canons Canons of taxation refer to the characteristics or qualities which a good tax system must have. A Double Taxation Avoidance Agreement is a tax treaty between two or more nations that prevents the same income from being taxed twice DTAA.

B The corporation pays taxes on its earnings and creditors pay taxes on interest received. B The corporation pays taxes on its earnings and creditors pay taxes on interest received. The corporation pays taxes on revenues and expenses.

Money doesnt pay taxes people do it based on the income they receive. In double taxation companies are taxed according to one. Categories of Double Taxation.

9 Double taxation refers to which of the following scenarios. A Both bondholders AND shareholders of a corporation must pay taxes on proceeds received. C The corporation pays taxes on its earnings and shareholders pay taxes on dividends received.

12014 on Withholding Tax on Special Classes of Income and Practice Note 22017 issued by the Malaysia Inland Revenue Board. OA Both bondholders AND shareholders of a corporation must pay taxes on proceeds received. The corporation pays taxes on its earnings and creditors pay taxes on interest received.

The tax system does not work by taxing money it works by taxing people. This is achieved mainly by the granting of double tax relief by the country of residence. Double taxation refers to which of the following scenarios.

13 Refer to Scenario 27-1. The treaty must be ratified by both countries before it will enter into force. If Country A and B are different the double tax treaties will determine where taxes should be paid usually based on the type of income.

Mark a resident of Isabela Province had the following data during this current taxable year assuming that the exchange rate is 1 - P54. A Both bondholders AND shareholders of a corporation must pay taxes on proceeds received.

Solved 9 Which Of The Following Is Not An Advantage Of A Chegg Com

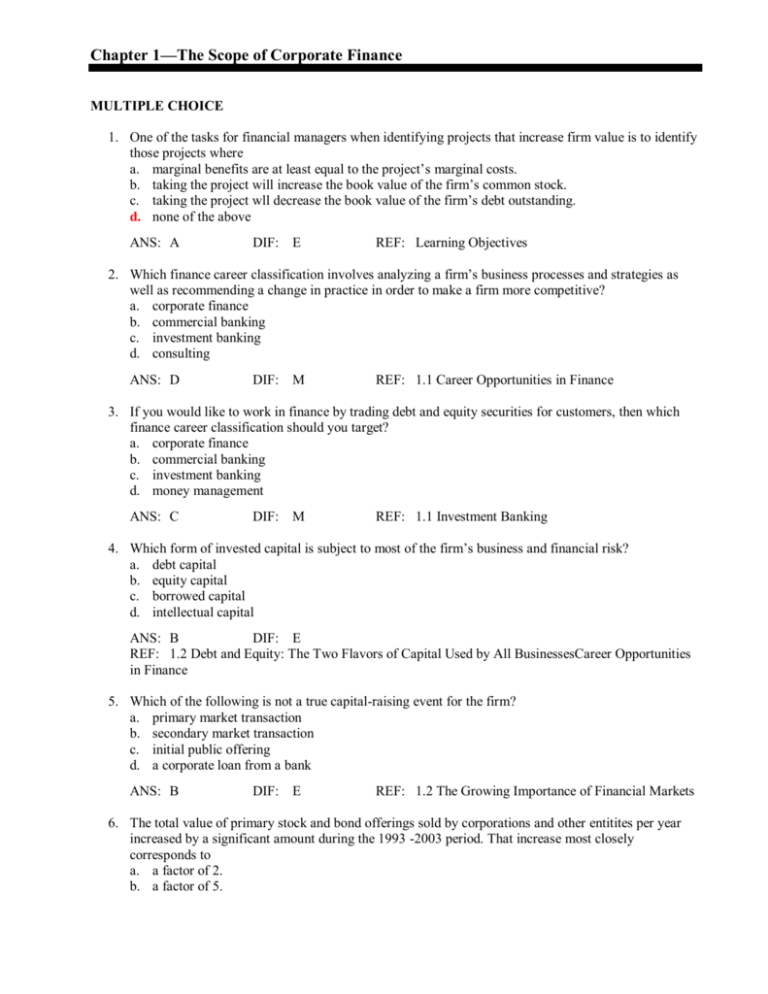

Chapter 1 The Scope Of Corporate Finance

Pdf Double Taxation And Double Non Taxation As The New Tendencies Of Eu E Tax Law

No comments for "10 Double Taxation Refers to Which of the Following Scenarios"

Post a Comment